It is vital to understand that the banksters create money through lending, it did not exist until the customer agreed to take on the debt. The bank simply created it out of thin air by tapping some numbers into a computer and updating the account ‘balance’ of the borrower. They never physically held the money to lend in the first place, it exists only in their digital ‘financial system,’ not in reality. What’s worse is that at least 97% of all money (Fiat currency) is created this way. It is a scam.

By using the word ‘bankster’ it must mean I’m an antisemite who believes in a global Jewish conspiracy to control the world’s finances. This is, after all, the refrain of all those who claim any criticism of the international banking system must denote fascist tendencies. ‘Bankster’ (a portmanteau of ‘banker’ and ‘gangster’) first appeared in the lexicon in the 1930’s during the Pecora senate hearings investigating the 1929 Wall Street Crash. It was later popularised by the Austrian School economist, historian and political theorist Murray Rothbard. Rothbard was Jewish, as was his economist inspiration Ludwig Von Mises who was forced to flee Nazi occupation in Europe. Some have alleged that Rothbard was antisemitic because he argued for a precise definition of antisemitism and found merit in some of the ideas expressed by Charles Murray, Harry Elmer Barnes and others. This is nonsense.

In reality, just like today, the ‘accusation’ of antisemtism was used to distract attention away from Rothbard’s economic ideas. Particularly his criticism of the Federal Reserve. As the historian Antony C. Sutton observed:

“The persistence with which the Jewish-conspiracy myth has been pushed suggests that it may well be a deliberate device to divert attention from the real issues and the real causes……..What better way to divert attention from the real operators than by the medieval bogeyman of antisemitism?”

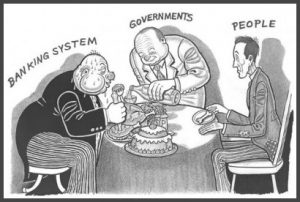

This truth about money, you are not supposed to know, is that it is created virtually from nothing. Some people, we call bankers, are effectively licensed to print money (digitally.) This is legalised usury and it gives them immense power. When I say ‘banksters’ I’m not talking about your local bank teller or branch manager, nor even the rank and file executives or city floor traders, I am referring to the beneficial owners and major shareholders of the banks. In particular those who own central banks because, despite what we are told, they are privately owned.

With unlimited wealth at their fingertips the banksters form the core of the global elite as a result. They operate a kind of global ponzi scheme which, while not illegal under international law, has all the attributes of a criminal enterprise. It is not without justification that these individuals can and are referred to as banksters. It should also be noted that their influence over the judicial system is also without limit.

While the establishment they lead don’t want you to understand any of this, occasionally their representatives inadvertently let the cat out of the bag. Mervyn King, the former governor of the Bank of England, speaking in 2012 said:

“When banks extend loans to their customers they create money by crediting money to their customers’ accounts.”

However, once the bank has conjured the money out of thin air, the debtor (victim) still has to go and earn that equivalent amount, by selling their labour, in order to pay it back, plus interest. For every Dollar, Pound or Euro they pay back, the bank adds that to their own ‘liquidity’ and proceeds to lend at least ten times that amount out to their next victim. This means, in effect, the customers work for the banks but are never paid. The customers are the bank’s debt slaves. It is no coincidence the etymological translation of ‘mortgage’ is ‘death pledge.’

This is just the start of the banksters’ deception. Current economic theory suggests that central banks (the national banks that commercial banks use) create the money supply. This is supposedly a controlling mechanism of ‘monetary policy’ exercised by government. Theoretically the money issued by central banks, the ‘base money,’ sets a limit on the bank’s liquidity, thereby restricting the amount of money created by banks when they make loans. This is supposed to work through a monetary process called the ‘money multiplier.’

If you deposit £1000 of your salary into your commercial bank account they assume you won’t need all your money in one go, the bank only keeps 10% as a reserve (in our example.) They then proceed to loan £900 of the ‘deposit’ to other people. The banks use your money as if it belongs to them (which it does.) When you check your balance and it states you’ve got £1000, the bank has already given £900 of it away, your balance are just some numbers on a screen. The bank have taken your money to make more profit for themselves.

Let’s say the person who borrowed your £900 used it to buy a new TV. The TV store then deposits the £900 in their bank account. Their bank then repeats the process. It retains a reserve percentage, £90 (10%) and loans out the remaining £810. Therefore, the £1000 you earned by working has already generated £1710 (£900 + £810) of debt. This process is repeated, again and again, until your initial £1000 deposit has created £10,000 of debt in the economy. So the only money ‘earned’ in the ‘real economy’ was your initial £1000. The other £9000 is debt created by the banks for their profit.

There are three types of money. Cash is printed by permission of the central banks, i.e. The Bank of England, Federal Reserve, European Central Bank etc. It is ‘sovereign money.’ The second type is called ‘Central Bank Reserves.’ When banks transfer money between each other this is done electronically, as a function of central banking, using each banks ‘Central Bank Reserves.’

There are three types of money. Cash is printed by permission of the central banks, i.e. The Bank of England, Federal Reserve, European Central Bank etc. It is ‘sovereign money.’ The second type is called ‘Central Bank Reserves.’ When banks transfer money between each other this is done electronically, as a function of central banking, using each banks ‘Central Bank Reserves.’

For example, when you buy something online you instruct your bank to withdraw the correct amount from your account and deposit it in the sellers bank account. Commercial banks don’t physically send cash to each other they just adjust their balance sheets with the central bank. Your purchase reduces your banks ‘Central Bank Reserve’ balance and the ‘Central Bank Reserve’ balance of the sellers commercial bank increases by the equivalent amount. ‘Central Bank Reserves’ are like electronic cash that only banks can use. This process of transferring money between different banks is called ‘inter bank settlement.’

The third type of money is ‘bank deposits.’ This is your bank ‘balance.’ Remember this money has already been issued, in the form of credit, to other people many times over. It only exists as numbers on a computer screen, as a result of debt, and as a bank liability to you. It is a form of bank ‘liability’ because they theoretically owe you the equivalent cash amount, but it isn’t cash itself. If you pay a bill by standing order the banks use inter bank settlement not your ‘bank deposit’ because that doesn’t really exist as money (they’ve already used it to make loans.) Its just a fluctuating figure on a spread sheet.

When you look in your bank account and it states you have £1000 ‘balance’ but only a smaller amount ‘available’ this is due to the time it takes for the interbank settlement process to complete. Running this system on a national and international scale means millions of transactions occur every day. It would be unworkable if every single transaction was processed individually. So banks use ‘multi-lateral net settlement.’ This means many of the transactions are cancelled out.

Imagine you pay your £500 electricity bill from your Barclays account. Once you authorise the payment, it is transferred into the Lloyds account of the electricity company. However, at the same time a Lloyds customer buys a fridge and transfers £600 into the Barclays account of the store who sold it. Using the process of ‘netting,’ Lloyds simply pay Barclays the difference of £100 using their Central Bank Reserves. In this way millions of transactions are wiped out every day. This means the banks need only move a small percentage of the total value of all transactions.

Consequently, banks only hold a tiny fraction of customers deposits because most transactions effectively disappear during ‘netting.’ Just before the financial crash in 2008, the Royal Bank of Scotland had £700 billion of customers money showing in its account balances. But it only held £17 billion of reserves to settle payments. Posing the question, where did the other £683 billion of peoples earnings go? What had the RBS done with everyone’s money?

When central banks create money to ‘capitalise’ a commercial bank the banksters don’t drive an armoured vehicle, full of cash, to the bank’s vault. The banksters simply increase the commercial banks Central Bank Reserves by the specified amount. Using the ‘money multiplier’ commercial banks retain a percentage reserve (in accordance with the ‘regulations’) and lend the rest of it to customers, creating both debt and additional money. Nonetheless, in theory, because each commercial bank has to retain reserves of ‘base money’ to meet its obligations to the central bank, the total amount of currency created by lenders is ultimately controlled by the central banks. Unfortunately, this doesn’t work.

The money multiplier theory suggests that Central Banks can control the amount of money created in a couple of ways. Firstly they can change the reserve ratio commercial banks need to retain. At 10% it creates a tenfold increase in the money supply as banks create debt, at 20% a fivefold increase, 5% twenty times more and so on. The other way the Central Banks can supposedly create more money is by printing it as cash (sovereign money.) In theory if the Central Banks creates £1000 and puts that into the economy, by the time it’s been through the money multiplier, it should generate no more than £10,000 of new ‘base money.’ However, this theory, taught to most economists, does not reflect reality.

Commercial banks don’t wait for customer deposits to be paid in. They just ‘assume’ they will be paid. They are not responsive to the underlying drivers of the economy, they create them. Secondly many central banks don’t set any reserve at all. There is no requirement for banks, in the UK for example, to retain a minimum ‘liquidity’ amount of ‘sovereign money’ as a ratio of total lending. Instead, they can ‘leverage’ it against their earnings. Banks ‘earn’ their money through interest on loans and speculation in the markets.

Fractional reserve banking is an idea that is hundreds of years old but, during the 1980s, thanks to the economic ideas associated with Reaganomics and Thatcherism, the banks minimum reserve levels were abandoned. They were instead required to meet the requirement laid out in the Basel Capital Accords. This was the idea of the most powerful bank in the world, the privately owned Bank for International Settlements (BIS) based in Basel, Switzerland.

Whereas true fractional reserve banking required banks to hold a minimum reserve amount of ‘sovereign money’ and Central Bank Reserves, the Basel Accords set much lower requirements. The reserve percentage was reduced to 8% by the Basel-I agreement, but even this didn’t have to be sovereign money issued by central banks. Commercial banks could instead buy government bonds (called ‘gilts’ – effectively shares in a nation’s economic productivity) and use them as liquidity. Previously only central banks could do this. Lending, creating money out of thin air, became even easier for commercial banks. Instead of creating 90% of the money in the economy the privately owned banks could now create at least 92% of all Fiat currency.

This increase in the money supply didn’t mean the population were universally better off. Far from it. The 1980s and 90s saw a marked growth in inequality. Largely due to rapid inflation, the poor saw no improvement at all, and the period was characterised by chronic unemployment and under-investment in essential infrastructure.

This increase in the money supply didn’t mean the population were universally better off. Far from it. The 1980s and 90s saw a marked growth in inequality. Largely due to rapid inflation, the poor saw no improvement at all, and the period was characterised by chronic unemployment and under-investment in essential infrastructure.

The middle class saw their relative share of wealth stagnate and start to decline as the new century began. All the economic growth resided in the top 5% of income earners, the so called ‘Yuppies’ (young urban professionals,) who were mainly investors and market speculators. They created the wealth by burdening the rest of society with crippling debt, while amassing increasing, personal fortunes.

The other ‘upwardly mobile’ sector was the construction industry, who profited from the mortgage debt of home-owners (assisted by government policies to encourage home ownership.) This caused the rapid expansion of an ultimately catastrophic housing price bubble. As credit started spiraling out of control, government was completely powerless to do anything about. They were not in control of the money supply, the banksters were.

The wild speculation of investors, fueled by virtually free money created by the banksters, inevitably led to a financial crash. Banks had taken mortgages and bundled them together as ‘mortgage backed securities.’ These bundles of mortgages were a type of financial product called ‘derivatives.’ The commercial banks sold these derivatives and, in doing so, removed the mortgage ‘liabilities’ off their accounts and onto those of the derivative buyer’s. This freed up additional liquidity for commercial banks, because their liabilities dropped in comparison to their assets. So they increased the money supply even further by creating more debt.

These mortgage derivatives were supposedly based upon legally binding mortgage agreements and, due to the high interest returns built into the mortgage contracts, were attractive investments for people who manage pension funds, investment portfolios and hedge funds. The problem was, huge numbers of these mortgages were mis-sold, by the banksters, to people who couldn’t afford them. No matter what the law says, if you owe twenty times your annual salary, paying it back isn’t an option for most people.

Starting in the U.S. in 2006, investors began to realise that mortgage backed securities were worth far less than the banks had told them. The banks had been handing out mortgages, regardless of anyone’s ability to repay. Market confidence plummeted as people understood the banks had ripped them off. This caused runs on the banks as millions of people tried to withdraw their money. When RBS customers demanded theirs back, they realised the bank had already spent it by mis-selling worthless derivatives and wild speculations in the financial markets, which they had also just played a part in bankrupting.

RBS weren’t alone, their situation was symptomatic of a disease infecting the entire banking system. However, because banks have the power to create the money in the economy, they simply told the governments to bail them out. Instead of pumping currency into the economy they sucked it dry. Government were not in charge of the decision-making. Banks ordered them to tax their populations to protect their failed businesses. They also told them to create more money by using the central banks to produce more in a process called ‘quantitative easing.’ All of this money was created as national debt. The banks claimed it as their own and carried on business as usual.

If you doubt that banksters were in charge of government you only need to see how so called ‘government’ have responded since the banks caused the last global recession. Having recapitalised the banks with tax payers’ hard-earned money, forcing millions into faux austerity, you would think, if governments were in charge, measures would have been taken to protect the economy against this happening again. There is no doubt that politicians knew full well what happened. Speaking in 2016 the UK Chancellor of the Exchequer George Osborne said:

“The last time Britain faced an economic shock the banks were at the heart of the problem.”

This was certainly the case. However, he then added:

“Thanks to the hard work of rebuilding the banks, making them stronger and safer, and the arrival of new challenger banks – banks and building societies are now part of the solution. The government gave the Bank of England new counter-cyclical capital buffer powers to support lending in the financial system in the good times and bad.”

In response to the financial crisis, in 2011, the banksters who own the Bank for International Settlements decided the best thing they could do was make it easier for themselves to create more money and more debt. The Basel III accord decreed that banks needed to retain just 3% liquidity against their liabilities. Not only was this reduced to 3%, banks could include their projected profits as assets. Therefore, if the interest on a loan was more than 3% (and they always are,) they don’t need any real ‘liquidity’ to create as much debt as they liked. They now have the power to create at least 97% of all money in the economy, purely as debt. Governments around the world have no say in the matter.

In response to this, in the UK, the Bank of England announced that they would require banks to reserve an additional 0.5% of capital. This was the ‘counter cyclical buffer’ Osborne referred to. In July 2017 the Financial Policy Committee of the Bank of England decided not to bother after all, and scrapped the idea.

Derivatives are ‘financial products.’ They are a type of financial ‘security’ based upon the value of an underlying asset. They are contractual, backed by international commercial law, and the price of the derivative depends upon the value of the assets it contains. For example, ‘mortgage backed securities’ were derivatives that were each worth the collective value of the mortgage agreements bundled together within them. However, bundling mortgages together isn’t the only type of derivative. Stocks, bonds, commodities, currencies and other financial ‘assets’ are also used to create derivatives. These can then be traded on the exchanges in the financial markets.

Currently the worldwide derivatives market, you know, the thing that destroyed the world economy in 2007, is worth an estimated $1.2 quadrillion, that’s more than 10 times the size of the planet’s Gross Domestic Product (GDP). This means, if you added up everything the world produces in a year, including all the bank deposits of all the people on earth, it would add up to 10% of the amount of money that banksters have invested in ‘financial derivatives.’ Some economists have argued this is an exaggerated calculation. It’s only about $550 trillion, according to the BIS, so only 5 times larger than the planets GDP. Phew! That’s OK then. In the UK alone, in 2015, the UK’s real debt stood at £15.8 trillion, more than 8 times the size of the entire UK economy.

It gets worse.

The money we use is called Fiat currency. This means ‘let it be done’ and signifies that money is created by law. It is supposedly a function of government which they administer through the process of central banking. This is certainly the impression given by academia and the one most economists learn when they go to educational institutions which usually receive funding from huge philanthropic foundations such as the ‘Carnegie Foundation.’ The banks in other words.

The money we use is called Fiat currency. This means ‘let it be done’ and signifies that money is created by law. It is supposedly a function of government which they administer through the process of central banking. This is certainly the impression given by academia and the one most economists learn when they go to educational institutions which usually receive funding from huge philanthropic foundations such as the ‘Carnegie Foundation.’ The banks in other words.

Economic text books provide all sorts of complicated justifications to reinforce their view that Central Banking is a government led activity carried out in the public interest. However, as Einstein allegedly warned:

“If you can’t explain it simply, you don’t understand it well enough.”

Two highly influential economist’s text books are ‘Economics,’ edited in 2009, by Krugman and Wells (K&W) and the 2011 edition of a book of the same name by Mankiw and Taylor (M&T.) Neither of them reference the fact that commercial banks create 97% of all money. Rather than address this issue, they offer all sorts of convoluted ‘work arounds’ which appear to deliberately avoid discussing the subject. They are also at pains to assert that central banks are somehow institutions of government. This is absolutely wrong.

Central banks are privately owned. You are simply deceived into imagining otherwise, though since the financial crash of 2007 more have come to recognise the reality.

In reference to the U.S. Federal Reserve bank (the Fed) K&W state:

“…the legal status of the Fed is unusual: It is not exactly part of the U.S. government, but it is not really a private institution either.”

This is certainly ‘unusual.’ Terms like ‘not exactly’ and ‘not really’ mean nothing, and seem strangely out of place in a supposedly definitive text book. K&W appear unwilling to be specific, leaving budding economists none the wiser about the reality. However, they offer clues by stating that the Fed’s board of directors are, “from the local banking and business community.” They later qualify this statement by saying:

“…….the effect of this complex structure is to create an institution that is ultimately accountable to the voting public, because the Board of Governors is chosen by the president and confirmed by the Senate.”

This is highly misleading. Firstly it isn’t a complex situation, it is really very straightforward. Two thirds of the Fed’s board of directors are selected by privately owned commercial banks and the other third, represented by the Board of Governors, though ‘chosen’ by the Senate (who the banksters spend billions funding and lobbying,) are also largely commercial bankers. The truth is the Fed is controlled by private commercial banks not the other way around, as suggested by K&W.

While extremely reluctant to even discuss how money is created, which is itself incredible given that these texts are supposedly about economics, both K&W and M&T insist that currency is created by central banks via the money multiplier. They both state that money is only created because central banks and customers ‘deposit’ money in commercial banks. By clinging to the false notion that banks need deposits, before they can create money, they suggest that commercial banks are merely ‘intermediaries’ in the creation of money, which is ultimately controlled by the central banks through issuing ‘sovereign money.’

This is the opposite of the reality. Commercial banksters create money (at least 97% of it) by making loans, producing debt. Human beings then sell their labour, provide services, manufacture and trade goods, to work off the debt. Even if you have never taken a loan in your life, the money you earn is 97% debt based. It is all someone’s debt. Without debt, it simply wouldn’t exist. The economic text books also completely obfuscate the fact that central banks are also owned by private individuals. We don’t have a monetary system we have a privately owned debt system controlled by banksters.

Speaking in 2012 Jens Weidmann (then president of the Deutsche Bundesbank – German Central Bank) argued that central banks were created by governments to create Fiat currency in order to fund government expenditure. He warned of the danger of government controlled central banks mismanaging the monetary system:

“If we look back in history, we see that government-owned central banks were often created with the purpose of giving those governing the country free access to seemingly unlimited financial means.”

At the same meeting of the ‘Institute for Bank-Historical Research’ in Frankfurt, a chief economist for the European Central Bank and Bundesbank, Otmar Issing, also spoke about ‘currency’ creation. He was discussing the idea of economist Friedrich August von Hayek that central banks should be disbanded and commercial banks allowed to issue currency in competition with each other. Like Weidmann, Issing completely avoided any reference at all to the fact that commercial banksters were already creating money. Furthermore, he maintained that central banking was essentially a function of government. This simply isn’t true.

In 1694 the Bank of England (BofE) was founded. It established the modern model of central banking still used today, though the first ever central bank was the Rothschild owned Amsterdam Exchange Bank formed in 1609. The bank took gilts (government bonds) from the British government as ‘securities’ and issued currency in exchange.

In 1694 the Bank of England (BofE) was founded. It established the modern model of central banking still used today, though the first ever central bank was the Rothschild owned Amsterdam Exchange Bank formed in 1609. The bank took gilts (government bonds) from the British government as ‘securities’ and issued currency in exchange.

This money was issued as a loan, fully repayable plus interest. Consequently, the government had to pay the BofE back all the money created by the central bank, plus interest at a rate stipulated by the individuals who owned the BofE. The only money governments have access to comes through taxation. So, when ‘sovereign money’ (cash) is created by central banks it exists as government debt secured by gilts. All money, even sovereign money, is debt.

The Bank of England was privately owned by its shareholders until 1946 when it was supposedly ‘nationalised’ (taken into government ownership.) We are asked to believe that immensely wealthy individuals, who had the power to create all money, simply gave this power up to the government. This arrangement was little more than a transparent subterfuge to hide the fact that the BofE remained in private control.

Following WWII the British Government was practically broke and owed huge debts to U.S financiers. It certainly didn’t have the capital to buy out the BofE. In order to ‘buy’ the bank the government were forced to issue bonds (gilts) to the shareholders in return for BofE shares. In theory this meant that the British Government could now receive a profit from issuing of Fiat currency (to itself) in exchange for more gilts. While the government were now the major shareholders of the BofE they were even deeper in debt to the former shareholders who still sat on the BofE board and still controlled the money supply. As these same people were also holding onto massive amounts of gilts, they now practically owned the UK economy. To give you some idea how preposterous the notion that the British Government ‘own’ the BofE is, you need look no further that the BofE’s own website which states:

“When the Bank was nationalised in 1946, it meant that it was now owned by the Government rather than by private stockholders. This gave the Government the power to appoint the Bank’s governors and directors, and to issue directions to the Bank. To date, the Government’s power to issue directions has not been used.”

In other words the BofE has continued to operate its business without any interference from the British Government at all. In 1977 the BofE set up a wholly owned subsidiary private company called the Bank of England Nominees limited (BOEN ltd.) Unlike every other private limited company in Britain, BOEN was uniquely protected by the Official Secrets Act. It issued 100 shares to unnamed individuals which they purchased for £1 each. All other companies have to register with ‘Companies House’ and disclose their beneficial ownership (who owns them.) In 1976, then British Secretary of State for Trade, Edmund Dell, exempted BOEN from this requirement. You were simply not permitted to know who owned the Bank of England, but it wasn’t the British ‘elected government.’

Responding to researchers Freedom of Information requests about who owned BOEN the BofE wrote:

“BOEN acts as a nominee company to hold securities on behalf of certain customers. It is a private limited company, incorporated in England and Wales.”

‘Holding securities,’ and issuing sovereign money in return, is the primary business model of the BofE. Those ‘securities’ are government gilts. The BOEN articles of association stated its role was:

“To act as Nominee or agent or attorney either solely or jointly with others, for any person or person’s, partnership, company, corporation, government, state, organisation, sovereign, province, authority, or public body, or any group or association of them….”

Following question in the British Houses of Parliament about BOEN, in 1977 Secretary of State Clinton Davis stated:

“They will hold securities as nominee only on behalf of Heads of State and their immediate family, Governments, official bodies controlled or closely related to Governments, and international organisations formed by Governments or official bodies.”

Therefore BOEN was a privately owned company that held government securities, on behalf of Heads of State and others, and acted as the government’s ‘agent’ within the business of the Bank of England. It’s supposed share value was £100. These were the same families who received the gilts in 1946 when the bank was supposedly nationalised. The ‘business’ of the Bank of England is to issue Fiat currency to both the government (in exchange for the gilts held by BOEN) and to privately owned commercial banks.

It is pointless to speculate who the BOEN shareholders were, though many did, because we were all barred from this information in our free and open democracy. The important issue is to understand that the act of creating sovereign money remained a privately owned, commercial enterprise.

BOEN was officially dissolved in 2017. This followed a change in the exemption it held under Sec 796 of the Companies Act 2006. As a consequence it was compelled to publish its full accounts, like all other companies. According to BOEN accounts it has carried out no business at all, traded nothing, returned no profit or loss and was entirely dormant for the 41 years of its existence.

While dormant companies aren’t unusual, it is rather silly to believe that a company set up to hold government bonds on behalf of some of the richest people on Earth would never engage in the business for which it was established. Rather like the ‘nationalisation’ of the BofE in 1946, we are again asked to accept that, given this immense financial power, those who held it did nothing with it and made no profit at all. Presumably because they either couldn’t be bothered or were squeamish about abusing their unimaginable wealth and influence. Unsurprisingly the BofE was granted full independence from government in 1997, though seeing as government has never used its supposed influence, you might ask independence from what?

Professor Carrol Quigley, in his influential work ‘Tragedy and Hope: A History of the World in Our Time,’ wrote:

“The power of the Bank Of England and of its governor was admitted by most qualified observers. In January 1924, Reginald McKenna, who had been Chancellor Of The Exchequer in 1915-1916, as Chairman of the Board of The Midland Bank, told its stockholder: ‘I am afraid the ordinary citizen will not like to be told that the banks can, and do, create money…And they who control the credit of the nation direct the policy of Governments and hold in the hollow in their hands the destiny of the people’…………”

Quigley also noted:

“…..the powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country to the economy of the world as a whole.”

When ‘Tragedy and Hope’ was first published, the publisher was quickly bought out and all the original plates and copies were destroyed. Book burning in action. Thankfully it was too late. Enough copies had already been sold and it still exists today. The importance of Tragedy and Hope cannot be overestimated. Quigley was an insider who was granted access to the inner workings of the elite as their chosen biographer. The book he wrote, at more than 1500 pages, revealed far more than his subjects desired. It takes some getting through, but if you are interested, there is a much easier to read, accurate summary called Tragedy and Hope 101.

The Federal Reserve Bank of the United States is also privately owned. In 1910 a group of influential bankers including representatives from the Rockefeller, Warburg, JP Morgan and Kuhn, Loeb & Company and other private corporate interests met on Jekyll Island in Georgia where they agreed how the U.S. economy would be run. They used their immense power to ensure the U.S. government passed the Federal Reserve Act of 1913 which was strongly advocated by their front man, Sen. Nelson Aldrich. Their ability to create money, by holding government bonds as securities before issuing money as government debt, is one side of a two-sided coin. In order to pay back the loan the U.S. government needed to generate income. It is no coincidence that 1913 was also the same year U.S. government created universal income tax.

To this day, the twelve regional Federal Reserve Banks, which are in charge of regulating banks, are owned and governed by their privately owned member banks.

Colonel Ely Garrison was a close associate of both Presidents Roosevelt and Wilson. Talking about the creation of he Federal reserve he stated:

“Paul Warburg was the man who got the Federal Reserve Act together after the Aldrich Plan aroused such nationwide resentment and opposition. The mastermind of both plans was Baron Alfred Rothschild of London.”

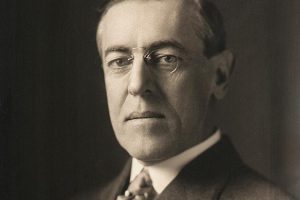

Woodrow Wilson recognised the huge mistake he had presided over. He saw that giving a small clique of individuals the power to create money made them powerful beyond all measure. He recognised the inherent danger, unfortunately he seemed powerless to stop it, he wrote:

“A great industrial nation is controlled by its system of credit. Our system of credit is privately concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men…”

[Woodrow Wilson – The New Freedom]

“We have come to be one of the worst ruled, one of the most completely controlled and dominated, governments in the civilized world – no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and the duress of small groups of dominant men.”

[Woodrow Wilson – Benevolence, or Justice?]

Nearly all central banks, across the planet, operate on the same principle. More importantly, they are controlled by the same tiny clique of people, something we’ll discuss shortly. The intimate relationship between commercial banks, corporate investors and central banks is clear. Government are powerless to influence their decision-making.

For example, following the global financial crisis in 2007, in the European Union, two global financial institutions, The European Central Bank (ECB) and the International Monetary Fund (IMF) formed a policy making body with the EU Commission. This was commonly referred to as the ‘Troika.’

The Troika decided to enforce brutal austerity measures upon the people of Europe, with the worst effects felt in Greece, Portugal and Ireland. These countries saw their economies ripped apart. Not because the people had mismanaged their affairs but because their governments owed enormous debts to the ECB.

The EU Commission’s only role in this was to rubber stamp the policies dictated to them by the ECB and the IMF. The ECB is completely independent of government, and the IMF is headed by the financially negligent criminal, Christine Lagarde. Of the three, the ECB is the only one with the power to create money. Both the IMF and the EU Commission did whatever the ECB told them.

European people suffered appalling hardship, but they were utterly irrelevant. All that mattered was that the banks, who had lost all the money in the first place, remained profitable. The people were expendable, mere ‘collateral damage,’ as the ECB ignored even the pretence of democratic government and economically ravaged nation states, irrespective of the will of the people.

In order to understand the absolute synergy between commercial and central banks you need only look at the secretive cabal of bankers who drive global economic policy. Among these are the ‘Group of Thirty’ (G30.) There website states:

“Established in 1978, is a private, nonprofit, international body composed of very senior representatives of the private and public sectors and academia. It aims to deepen understanding of international economic and financial issues, and to explore the international repercussions of decisions taken in the public and private sectors.”

Their discussions are held in private and their lobbying power is limitless. Recently the European Union questioned ECB president Mario Draghi’s long-standing membership of this secretive group. He remains a member. A look at their 2013 membership gives us a glimpse of a few of the people who truly run the planet, and their ties to both central and commercial banking:

Mario Draghi (President of the ECB, formerly Goldman Sachs), Mark Carney (President of the Bank of Canada – from July 2013 of the Bank of England – formerly Goldman Sachs), William Dudley (President of the New York Fed, formerly Goldman Sachs), Gerald Carrigan (Goldman Sachs, formerly President of the New York Fed), Axel Weber (UBS, formerly President of Deutsche Bundesbank), Jacob Frenkel (JP Morgan Chase, formerly Governor of the Bank of Israel), Paul Volcker (former Fed – Chairman), Jean Claude Trichet (former President of the ECB), Leszek Balcerowicz (former Governor of the National Bank of Poland), Jaime Caruana (General Manager of the Bank for International Settlements and former Governor of the Bank of Spain), Guillermo de la Dehesa Romero (Santander, formerly Deputy Director of the Bank of Spain), Roger Ferguson (TIA A-CREF, formerly Swiss Re and formerly Vice-Chairman of the Fed), Stanley Fisher (Governor of the Bank of Israel, formerly IMF and formerly Citigroup), Arminio Fraga Neto (Gavea Investimentos, formerly Governor of the Central Bank of Brazil), Philipp Hilde brand (Blackrock, formerly Chairman of the Swiss National Bank), Mervyn King (Governor of the Bank of England until June 2013), Guillermo Ortiz (Grupo Financiero Banorte; formerly Governor of the Bank of Mexico), Masaaki Shirakawa (Governor of the Bank of Japan), Yutaka Yamaguchi (former Deputy Governor of Bank of Japan) and Zhou Xiaochuan Governor of the People’s Bank of China).

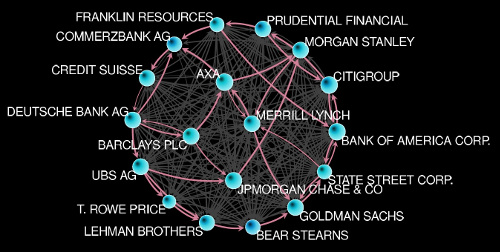

The Bank for International Settlements (BIS) acts as a clearing house for central banks. It provides the same kind of service to central banks they provide for their ‘commercial’ counterparts. It is undoubtedly the most powerful financial institution on Earth. 75% Of it’s stock (because it is a private limited company) is owned by central banks. However, seeing as these are privately owned, that means individual private ownership of the BIS. The other 25% is owned by commercial banks and individuals. Commercial banks are also privately owned. A very small group of private investors own the BIS which effectively controls all the money on Earth.

In 1992 the media commentator and Clinton election campaign manager, James Carville, came up with the phrase ‘the economy, stupid‘ as one of the campaigns main sound-bites. This has become the widely paraphrased saying, ‘it’s the economy, stupid.’ This is used to illustrate the point that, in modern political terms, the economy means everything.

The individuals who own both commercial and central banks have the power to create money out of the ether. They can make as much as they want to give themselves. They control all debt, all economies and virtually all governments. Everything on the planet, with a monetary value, is owned by this tiny cabal. Only they can create or destroy money and all money is a debt owed to them. As long as our current monetary system continues without reform, this gives them unimaginable, unlimited economic and political power.

They are the same tiny elite who own the 147 corporations that control the global productive economy. If you ever wonder who the World owes its estimated $233 trillion debt to, it’s the same junta of corporate financiers. They also own all the world’s mainstream media corporations and control the entire MSM news agenda.

They are the same tiny elite who own the 147 corporations that control the global productive economy. If you ever wonder who the World owes its estimated $233 trillion debt to, it’s the same junta of corporate financiers. They also own all the world’s mainstream media corporations and control the entire MSM news agenda.

A recent article, by the Independent’s economics editor Ben Chu, tried to offer the mainstream, apologist explanation for all this. Reading it reveals the nonsense that passes for modern economic and monetary theory. In reference to the $233 trillion global debt, Chu states that “debt is a form of wealth.” This is true, in fact debt is the only kind of wealth because all money is debt. When considering ‘who’ this money is owed to Chu writes:

“..’Us’ is the short answer. Every financial liability, which includes debt, has a corresponding financial asset. And all those financial assets are ultimately owned by someone. If you put your money in a bank account the bank is likely to loan the cash out to someone else to buy a house: your financial asset thus becomes someone else’s financial liability.”

This is either a damnable lie or economic illiteracy, perhaps a product of that which Mr Chu has been told to believe. The money multiplier is a standard monetary principle known to all economists and yet Ben Chu doesn’t tell you that banks don’t just lend ‘your’ money. Even with a fractional reserve ratio of 3%, they lend it thirty times over at least. He then attempts to explain the global economy while studiously ignoring any further reference to banking. As if banking, or even money itself, were entirely irrelevant to economics. Of course if he had referred to it he would almost certainly have been accused of anti-Semitism. Inevitably he ties himself up in some bewildering knots.

He states that governments:

“…….borrow money in a currency they themselves print, meaning that, in extremis, they can ensure lenders are paid back by printing money.”

Posing the obvious question, if this is true, why is there any national debt? Why don’t governments just ‘pay back’ whoever they borrowed it off by printing more money? Of course, this is complete crap.

If you increase the supply of anything you decrease its unitary value for a start. Even if we accept the economic orthodoxy regarding central banking, clearly governments don’t just print money. They trade gilts for capital. The central banks hold the gilts as securities on loans they make to the government in the form of ‘sovereign money’. This makes absolutely no sense at all if the government itself ‘owns’ the central bank. Why would the central banks need any security? What value do government bonds have to central banks if they are ‘owned’ by the government?

This would be like holding your own wrist watch as security against yourself before you used your own money to buy something. If you then lost your job, and were unable to replenish your own purse, your alter ego, because you borrowed the money from yourself, could then sell your own watch in order to recover the money you can no longer repay yourself. Obviously only your ‘other self’ would then have any money so presumably, if you then needed more, you would have to offer your wedding ring as additional security to yourself before you could give yourself your own money.

I labour the point, but I hope you can see what a total load of claptrap the Independent’s economics editor was peddling. He can only have been compelled into writing this nonsensical drivel for one of two reasons. Either he genuinely didn’t understand anything at all about banking, highly unlikely in my view, or he was desperately attempting to create a narrative that excluded banking and the monetary system as the cause of global debt.

Yet, despite the fact the idea of government ownership of central banks is completely illogical, it is the common view expressed by most economists. Mr Chu then compounded his own confusion, and that of the readers, by saying:

Governments, it is true, can still over borrow and run into a funding crisis.”

How? How can government over borrow from itself? Why does it need to borrow anything if it issues money to itself in the first place. How does borrowing from yourself work?

This is this fundamental dichotomy that lies at the heart of all accepted economic, and particularly monetary, theory. Government simply cannot be both the borrower and the ‘lender of last resort.’ The answer to this conundrum, far from being the complex web of flawed equations and intricate narratives offered by mainstream economists, is very, very simple.

Governments do not own central banks. From a purely historical perspective this is glaringly obvious, yet it is the idea which cannot speak its name. It is the ultimate economic taboo. Any economist who dares to even suggest it will become a pariah. A zealot, an idiot, a ‘conspiracy theorist.’ The banksters who really own central banks are the same people who are the major shareholders of all the commercial banks. If this is all starting to sound like a giant, though legal, fraud, it’s because that is precisely what it is.

We are given to understand that fractional reserve banking and Fiat currency is somehow necessary. That without it, the world would collapse. The only thing that would collapse is the current system that benefits a tiny elite at the expense of everyone else. There are plenty of alternative economic, political and monetary systems. The ‘Bradbury Pound‘ for example. It is certainly not beyond us to establish much better ways run our economy and our society. What the current system delivers is essentially feudalism on a global scale.

Only by thinking about these issues can we ever have any hope of resolving the world’s problems. Unfortunately the global elite, who own and control everything, are determined to ensure that we don’t. This is why, if you even mention the subject, you will be accused of anti-Semitism. It is a discussion we are not allowed to have and an opinion we are not allowed to hold.

No national economy can ever free itself from debt because Fiat currency is debt. When the money earned is returned to commercial banks, as deposits, it simply becomes their ‘liability.’ Nothing more than a theoretical concept, as clearly demonstrated by RBS. This effectively removes that money from the economy. Similarly, if the world’s governments ever paid off their national debts to the privately owned central banks, the money, under our current monetary system, would cease to exist. Causing a horrendous, global deflationary spiral.

Meanwhile, ‘the banksters’ have created an alternative economy, the derivatives market, that dwarfs the one the rest of us live in. Having financially outgrown the world’s productive economy, this enables them to consolidate even more wealth and power.

There is nothing beyond their reach. They order all governments and exert control through the unseen ‘Deep State‘ that uses a network of military, intelligence, political, bureaucratic and media ‘assets’ who determine policy and most major world events. They finance all sides in most wars for their own profit; they financially back popular movements and revolutions to achieve their geostrategic objectives; they destabilise states, as and when they see fit, to give the corporations they own access to that nations resources.

They use mass manipulation techniques to deliver whatever ‘public opinion‘ they desire. Their discussions are held in secret and rarely emerge into the public domain; all political parties, that have any realistic chance of forming a government, are financed by the corporations owned by the banksters; they use their immense power to create and destroy ‘single issue’ parties and lobby groups, as they wish.

They have compartmentalised the planet and devolve power only to their chosen acolytes who can be removed at any time of their choosing. If our elected leaders weren’t under their control, either by consent or coercion, we would never be offered them as an electoral choice.

Every time you vote you are merely perpetuating this system of global hegemony, which you can neither influence nor end through the ballot box. Whoever you elect you will get the government and they are not who you think they are. In order to be able to talk about this unseen government we need to give them a name. Let’s use the one their representatives have frequently mentioned.

Meet your real government, we might call them the New World Order.

Mr. Davis…Mahalo! – Your work has put more pieces of the UNDERSTANDING of Monetary Puzzle together for me. — Aloha! — M.S.A.

Pleased to hear it Mark. I hope it spurs on your own research. All the best.

Absolutely fantastic article by an enlightened writer/truth seeker, this piece remains informative and pardon the pun… – on the money.

Many thanks for the kind words and encouragement. Pun definitely excused 🙂

Excellent description of ‘our’ monetary system. And thank you for the lead to T&H101.

Thanks Sheldon. Yep T&H is important reading but it is a bit of a slog. T&H101 covers the salient points is sufficient detail and is much more digestible.

Dear Mr. Davis, The People’s Global Resource Bank Monetizes Nature. – John

Thanks much, Mr. Davis, for your exposition, containing much truth. In addition to all the subterfuge and apparent secrecy surrounding money creation/destruction, the very jargon used is misleading: ‘loan’ ‘borrower’ ‘capital’ etc. Commercial bank ‘loans’ are mainly (entirely?) not that, but are non-pre-existing ‘provisions’ (creations anew) with strings attached. Repayment of the ‘loan’ principal to the originating bank causes that principal to be extinguished as money, no? Next, how can we understand the problem that is caused by the money-manufacturer (bank issuing credit as principal) not manufacturing at the same time the funds with which to pay the ‘interest’ demanded? The ‘borrower’ must somehow obtain funds, from elsewhere in the economy, to cover the cost of debt payment. Does this not result in a financial game of musical chairs whereby those on the losing end then suffer bankruptcy, foreclosure, repossession, debtor’s prison, or worse? What about periodic ‘debt jubilee’ as in the Old Testament? What happens when banks ‘write off’ non-producing ‘loans’? It’s an absurd and evil system, of course. I’ve heard the criticism: ‘You can’t give government the power to run the monetary system; politicians would run it into the ground’ … as if the only alternatives are private-run or gov’t-run. How about non-profit 100% transparent non-politician-controlled competitive multiple options? Crypto? Also, to ward off the anti-‘them’ canard, consider focusing on the Kazarian mafia.

Thanks Rob.